Examples include accounts payable, loans payable, and accrued expenses. Liability accounts carry their balances forward and provide insight into the company’s debt and financial obligations. A real account, or permanent account, is a general ledger account that does not close at the end of a period or at the end of the accounting year. Instead of closing, real accounts stay open, accumulate balances, and carry over into the next period or year. The amount in real accounts becomes the beginning balance in the new accounting period.

Equity

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Examples of temporary and permanent accounts

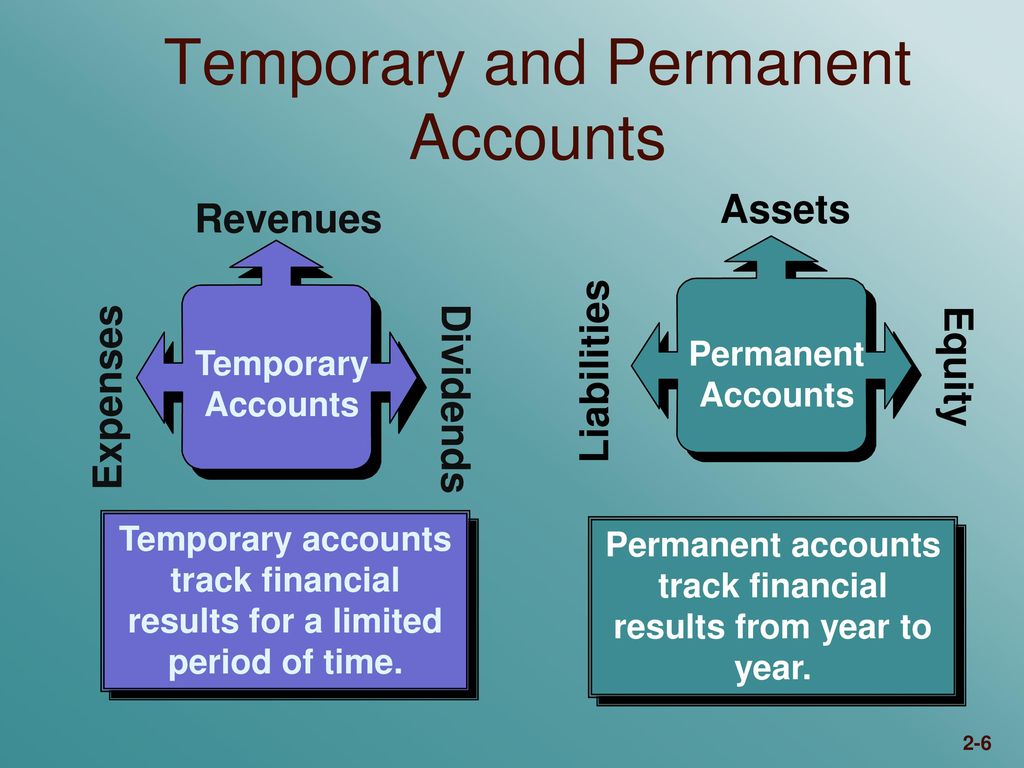

Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. You must close temporary accounts to prevent mixing up balances between accounting periods. Temporary accounts include revenue, expense, and gain and loss accounts. All accounts that are aggregated into the balance sheet are considered permanent accounts; these are the asset, liability, and equity accounts. All accounts that are aggregated into the income statement are considered temporary accounts; these are the revenue, expense, gain, and loss accounts.

What is a Temporary Account?

- Real accounts also consist of contra assets, liability, and equity accounts.

- You forget to close the temporary account at the end of 2021, so the balance of $50,000 carries over into 2022.

- Your accounting period goes from January 1 to December 31 each year.

- At the end of the period, the balances in these accounts are closed and transferred to retained earnings or capital.

Assets are usually listed on a company’s balance sheet and are categorized as either current or non-current assets. An asset is anything that a company owns that has value and can be used to generate revenue. Examples of assets include cash, inventory, property, and equipment. It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it. A permanent account does not necessarily have to contain a balance.

On a border note, HighRadius offers a cloud-based solution that helps accounting professionals streamline and automate the financial close process for businesses. We have helped accounting teams from around the globe with month-end closing, reconciliations, journal entry management, intercompany accounting, and financial reporting. Your accounting period goes from January 1 to December 31 each year. At the end of the year (or period), you report your revenue, COGS, rent, and other expenses on your income statement as $16,000 in net income. You forget to close the temporary account at the end of 2021, so the balance of $50,000 carries over into 2022.

What are the different types of accounts in accounting?

During the closing stage, all income and expense balances are transferred to the income and expense summary account and eventually to the retained earnings. This account serves as a temporary placeholder to compile and summarize all revenues and expenses at the end of an accounting period. After compiling the totals from revenue and expense accounts, the net income or loss is transferred to retained earnings, and the income summary account is closed.

These accounts are temporary accounts while all other accounts (all assets, all liabilities, common stock and retained earnings) are permanent accounts. These accounts are closed at the end of each period to reset their balances and prepare for the next accounting period. Your COA allows you to easily organize your different accounts and track down financial or transaction information. And, you transfer any remaining funds to the appropriate permanent account.

However, they are not closed, and the accounts remain active throughout the life of the business. As a result, when the new accounting period begins, the account maintains the closing balance from the preceding period. Financial statements are crucial documents that provide a snapshot of a company’s financial health. They are used by investors, creditors, and other stakeholders to evaluate the company’s performance and make informed decisions. The three main types of financial statements are the income statement, balance sheet, and cash flow statement.

One such expense that is determined at the end of the year is dividends. Emagia is a leading provider of AI-powered Order-to-Cash (O2C) automation platform that modernizes finance operations for midsize to large global businesses. Emagia solutions improve their customers DSO, cash flow, credit risk, operational cost, compliance and profitability.

Instead of closing entries, you carry over your permanent account balances from period to period. Basically, permanent accounts will maintain a cumulative balance that will carry over each period. Contra-asset accounts such as Allowance for Bad Debts and Accumulated Depreciation are also permanent accounts. Either which of the following accounts are permanent way, you must make sure your temporary accounts track funds over the same period of time. A few examples of sub-accounts include petty cash, cost of goods sold, accounts payable, and owner’s equity. To help you further understand each type of account, review the recap of temporary and permanent accounts below.

Say you close your temporary accounts at the end of each fiscal year. You forget to close the temporary account at the end of 2018, so the balance of $50,000 carries over into 2019. The amount of the profit or loss for a business during a certain period indicates the financial performance of the business. An income statement usually covers a year; however this statement may be drawn up for shorter periods, such as one month, three months or six months. This shifting to the retained earnings account is conducted automatically if an accounting software package is being used to record accounting transactions. Permanent accounts are accounts that you don’t close at the end of your accounting period.