The company can now take steps to rectify the mistakes and balance its statements. When the cash book is written up as fully as possible then proceed with the bank reconciliation steps as follows. There are a number of reconciliation procedures involved in preparing the bank reconciliation statement. The second main issue that can arise with a manual bank reconciliation process is that fraud may not be detected promptly, or in some cases, goes undetected. Here are two examples to reinforce the bank’s use of debit and credit with regards to its customers’ checking accounts. The Transaction Matching software utilizes AI to discover and configure matching rules, enabling automatic line-level transaction matching between different data sources.

To Ensure One Vote Per Person, Please Include the Following Info

We’ll explore the definition of bank reconciliation, why it’s important, and a step-by-step process for performing bank reconciliations. We’ll also look at common sources of discrepancies between financial statements and bank statements to help you identify fraud risks and errors. Performing regular bank reconciliations is key to keeping on https://www.bookstime.com/articles/accounting-for-architects top of your company’s financial health and paving the way for sustainable business growth. For smaller companies, it’s common to reconcile bank statements during the monthly or quarterly close process. However, there are situations where a bank reconciliation might be necessary at the earliest.

Why Is It Important To Reconcile Your Bank Statements?

- You will know about this only when you receive the bank statement at the end of the month.

- FreshBooks accounting software helps you track income and expenses and generate reports and financial statements.

- Next, we look at how a bank uses debit and credit when referring to a company’s checking account transactions.

- Typically, the difference between the cash book and passbook balance arises due to the items that appear only in the passbook.

- Make a list of these items as they will need to be accounted for to reconcile the balances.

- The term “bank reconciliation” actually refers to the process of verifying and adjusting cash movement.

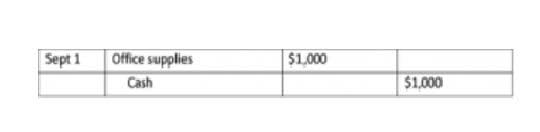

In order to prepare a bank reconciliation statement, you’ll need to obtain both the current and the previous month’s bank statements as well as the cash book. The purpose of reconciling bank statements with your business’ cash book is to ensure that the balance as per the passbook matches the balance as per the cash book. Your bank may collect interest and dividends on your behalf and credit such an amount to your bank account. The bank will debit your business account only when they’ve paid these issued checks, meaning there is a time delay between the issuing of checks and their presentation to the bank. These bank reconciliation time delays are responsible for the differences that arise in your cash book balance and your passbook balance. The following pages include a detailed illustration of the bank reconciliation process.

Adjusting the Bank Statement Balance

Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees. It’s recommended for a company to perform a bank reconciliation at least once a month. If your company receives bank statements more frequently, for example, every week, you may also choose to do a bank reconciliation for every statement you receive.

- There is vital room for human error when your accountants are working by multi-tab Excel workbooks that include hundreds or thousands of line items that need to be overviewed.

- These checks are in transit, so they haven’t yet been deposited into the company’s bank account.

- The company carries over the balance from its bank book to its trail balance and, subsequently, its financial statements.

- You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows).

- Since the bank statement balance according to the bank reconciliation matches the bank balance in the bank statement, the reconciliation can be considered correct.

Ask Any Financial Question

Companies prepare bank reconciliation statements as a comprehensive accounting comparison tool. A company can ensure fixed assets that all payments have been processed accurately by comparing their internal financial records against their bank account balance. Bank reconciliation statements are also important for alerting a company in case of fraud or error. To be effective, a bank reconciliation statement should include all transactions that impact a company’s financial accounts. The reconciliation of bank statements is a critical step in maintaining accurate financial records for any business, ensuring that the company’s accounting records are up-to-date and accurate. By reconciling bank statements regularly, business owners can identify any missing or duplicate transactions, bank errors, or fraudulent activity early on, before they pose significant challenges.