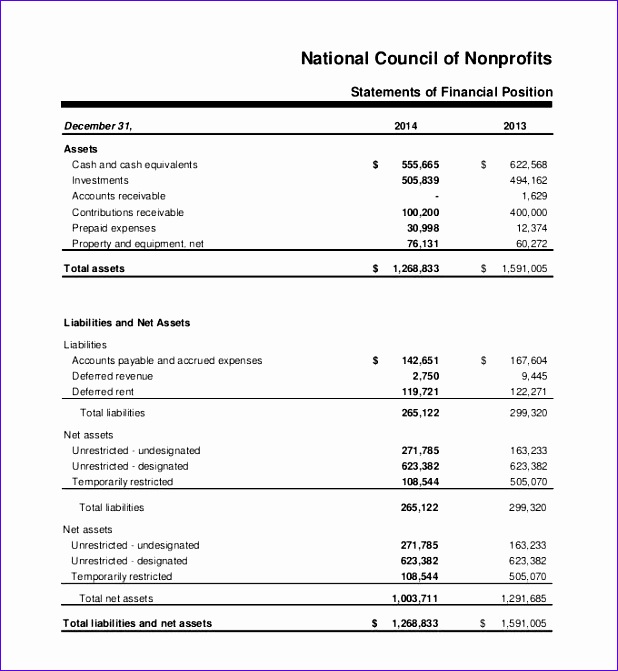

They represent the costs incurred by the organization in carrying out its activities and fulfilling its mission. It is essential for nonprofits to track and categorize their expenses accurately to ensure transparency and accountability. In this section, it is crucial to pay attention to the debt and accounts payable. These are key indicators of the organization’s financial health and its ability to manage its obligations. It is important for nonprofit organizations to carefully monitor and manage their liabilities to ensure long-term sustainability.

Common Challenges in Nonprofit Financial Reporting

For the most part, however, cash flow statements for non and for-profits are very similar. If you’ve dealt with for-profit cash flow statements before, this should look very familiar. Heliconia Scholarship Foundation shares a financial report with its donors instead of an annual report. This decision makes sense since donors to a scholarship fund are likely concerned solely with financial details from this organization. Nonprofits must include natural and functional classifications for all expenses.

Things to Look Out For on the Statement of Activities

Organizations will separate these expenses by programs, fundraising, and management. With each of these, nonprofits include salaries, events, administrative costs, etc. The first and most desired financial statement is the Statement of Financial Position. Nonprofits use this statement to share what their organization owns and what it owes.

- The first step to accounting for nonprofits is choosing whether your organization should use cash-basis or accrual-basis accounting.

- Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

- These disclosures provide a comprehensive view of the organization’s financial position and help users of the financial statements make informed decisions.

- We have created a sample balance sheet to help you create one for your organization.

Questions about opening a bank account?

Once you’ve got your bookkeeping system setup and have started generating financial statements, the final piece of the nonprofit accounting puzzle is getting your tax obligations straight. When comparing a nonprofit organization’s balance sheet to a for-profit one, there are several key distinctions to consider. One major variance is that a nonprofit’s balance sheet is also known as a nonprofit statement of financial position. This statement reflects the overall financial status and health of your nonprofit, showing what the organization owns and owes.

Nonprofit Balance Sheet Guide & Template

This is especially important since board members have a fiduciary duty—requiring them to be transparent about finances. Overall, significant accounting policies play a crucial role in nonprofit financial reporting. They determine how financial transactions are recorded, reported, and disclosed, and they provide stakeholders with valuable information about the organization’s financial health and performance. These guidelines provide specific rules and principles for recording and reporting financial transactions in the nonprofit sector. By following these guidelines, nonprofit organizations can ensure transparency and accuracy in their financial reporting.

The nonprofit organization’s statement of financial position, also known as the balance sheet, provides a clear picture of the organization’s financial health. It shows what the organization owes and what the organization owns, giving insight into the nonprofit’s financial situation. Financial management is crucial for assessing an organization’s financial position and ensuring its current financial health.

Compared with Wellington Zoo, the financial statements used in this report are easier to follow and provide fewer details. The primary reason for this is this method lets nonprofits record revenue when it’s earned. The first and most apparent liabilities are your organization’s operational costs. Your balance sheet will split assets by current assets, fixed assets, and others. This article shares what you should include in a nonprofit balance sheet and provides a sample of how to write your own.

Balance sheet is a crucial tool for evaluating organizational performance as it provides a snapshot of a company’s financial position at a specific point in time. It includes assets, liabilities, and equity, which can help stakeholders assess the financial health and stability of a business. If your organization uses an accrual method accounting practice, nonprofit balance sheets are more accurate. Funds are related to the day of the event instead of when funds actually arrive. Strong nonprofit accounting practices are the foundation for efficient financial management. Nonprofit organizations must adhere to Generally Accepted Accounting Principles (GAAP) when preparing financial statements.

The section of additional disclosures in nonprofit financial statements provides important information that goes beyond the basic financial data. It includes details about significant accounting policies, potential risks and uncertainties, and other relevant information that may impact the organization’s financial position and operations. Every nonprofit needs to maintain accurate financial records as part of financial self-employed 2021 management. The nonprofit balance sheet is also called a statement of financial position, which is one of the essential financial statements. Make sure that your nonprofit uses nonprofit accounting basics and nonprofit bookkeeping and accounting to ensure a healthy financial performance. Understanding net assets involves a clear grasp of the nonprofit balance sheet, also known as a statement of financial position.